The Best Guide To Hard Money Georgia

Wiki Article

The Only Guide to Hard Money Georgia

Table of ContentsHard Money Georgia - The FactsThe 20-Second Trick For Hard Money GeorgiaThe Hard Money Georgia IdeasHow Hard Money Georgia can Save You Time, Stress, and Money.Not known Details About Hard Money Georgia The Single Strategy To Use For Hard Money Georgia

A difficult money financing is simply a temporary lending secured by actual estate. They are moneyed by (or a fund of capitalists) in contrast to traditional lending institutions such as banks or cooperative credit union - hard money georgia. The terms are normally around twelve month, however the financing term can be included longer terms of 2-5 years.The quantity the difficult money lending institutions have the ability to offer to the debtor is mainly based on the value of the subject building. The residential or commercial property might be one the borrower already owns and wishes to make use of as security or it may be the property the borrower is getting. Tough money lending institutions are largely worried with the instead of the debtor's credit scores (although credit report is still of some value to the loan provider).

When the financial institutions claim "No", the tough money lenders can still state "Yes". A customer can get a difficult cash loan on almost any kind of sort of property consisting of single-family residential, multi-family property, industrial, land, and commercial. Some hard cash lenders might specialize in one certain home type such as residential and also not be able to do land finances, simply due to the fact that they have no experience around.

Some Known Details About Hard Money Georgia

When buying a key home with excellent credit scores, earnings background, as well as there are no issues such as a short sale or foreclosure, standard funding via a financial institution is the most effective method to go if the consumer still has time to experience the extensive approval process required by a bank.Tough money loans are optimal for circumstances such as: Land Loans Construction Loans When the Purchaser has credit report problems. When a genuine estate capitalist needs to act quickly. Investor pick to make use of tough money for several factors. The main factor is the capacity of the tough money loan provider to fund the lending swiftly.

Compare that to the 30 45 days it requires to obtain a small business loan moneyed. The application procedure for a hard money lending normally takes a day or more and also in some cases, a car loan can be authorized the same day. All the best hearing back regarding a lending authorization from your bank within the same week! The capacity to obtain financing at a much faster rate than a small business loan is a significant benefit for a real estate financier.

An Unbiased View of Hard Money Georgia

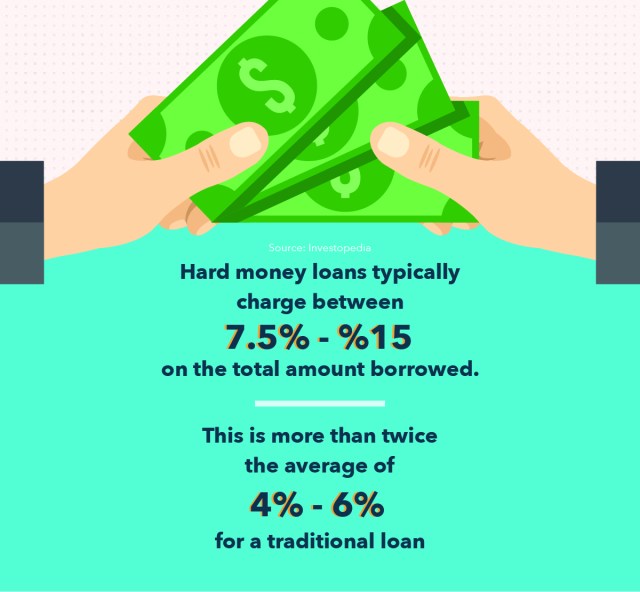

The rate of interest as well as factors billed by hard money loan providers will vary from lending institution to loan provider and also will likewise vary from area to region. Difficult cash loan providers in The golden state usually have reduced prices than other parts of the nation given that California has lots of difficult cash lending companies. Increased competition results in a reduction in rates.Because of this greater threat entailed on a difficult cash lending, the rates of interest for a difficult money financing will certainly be greater than traditional fundings. Rates of interest for hard cash car loans vary from 10 15% relying on the details loan provider and the regarded risk of the loan. Factors can range anywhere from 2 visit the website 4% of the complete quantity loaned.

The finance amount the hard money lender is able to lend is figured out by the proportion of the loan quantity split by the value of a residential property. This is called the finance to worth (LTV). Numerous tough cash lenders will certainly offer up to 65 75% of the current worth of the residential property.

Things about Hard Money Georgia

This develops a riskier finance from the tough money loan provider's point of view since the quantity of resources placed in by the lender rises and the amount of funding invested by the customer reduces. This boosted threat will certainly create a hard money lending institution to bill a higher rate of interest rate. There are some difficult money loan providers who will provide a high portion of the continue reading this ARV and will even finance the rehab prices.Anticipate 15 18% rate of interest and 5 6 points when a lender funds a finance with little to no deposit from the borrower (hard money georgia). In some cases, it might be rewarding for the debtor to pay these exorbitant prices in order to protect the offer if they can still produce revenue from the job.

They are less worried with the debtor's credit history score. Issues on a borrower's document such as a repossession or short sale can be overlooked if the borrower has the resources to pay the passion on the lending. The tough cash lender have to likewise take into consideration the borrower's strategy for the property.

The Greatest Guide To Hard Money Georgia

One more way to linked here discover a tough cash lending institution is by attending your regional actual estate financier club meeting. These club meetings exist in the majority of cities and are normally well-attended by difficult money loan providers aiming to network with prospective customers. If no hard cash loan providers exist at the conference, ask various other genuine estate capitalists if they have a tough money loan provider they can recommend.

Just how do hard cash car loans function? Is a difficult money finance appropriate for your scenario? Today, we'll respond to these concerns, giving you the breakdown of tough money loans.

The Definitive Guide for Hard Money Georgia

With typical car loan alternatives, the lending institution, such as a financial institution or cooperative credit union, will certainly check out your credit rating score and also confirm your revenue to figure out whether you can pay off the funding (hard money georgia). In comparison, with a tough money lending, you borrow cash from a private lender or specific, and their choice to provide will concentrate on the quality of the asset.Report this wiki page